RAC launches pioneering ‘no ties’ pay-by-mile car insurance

19 MAR 2021

‘Pay when you drive – save when you don’t’: drivers who travel fewer miles, including because of Covid, could save money

A true monthly subscription model, and customers pay nothing to leave if their circumstances change

With data showing drivers are covering 20% fewer miles than two decades ago* and the possibility of this trend accelerating post-Covid, the RAC is today launching a brand-new, flexible monthly subscription-based car insurance product aimed at saving money for people who drive under 6,000 miles a year.

Pay by Mile from RAC Car Insurance meets the changing needs of drivers and works by charging motorists a small agreed per-mile cost only for the miles they actually drive – the Mileage Premium – in addition to a set monthly fee to cover their vehicle while it’s parked – the Parked Premium. So, for those who drive relatively few miles, there may be significant savings to be had.

Keeping track of miles driven and monthly costs is easy with the Pay by Mile app, making it an ideal policy for anyone who drives infrequently or covers very different amounts of miles from one month to the next. There are no fees for changing vehicles or address, and any changes to either the Mileage or Parked Premium take effect immediately. And, with no ties, if a driver discovers Pay by Mile is no longer suitable for them or they sell their car, they can cancel straight away with no fees to pay.

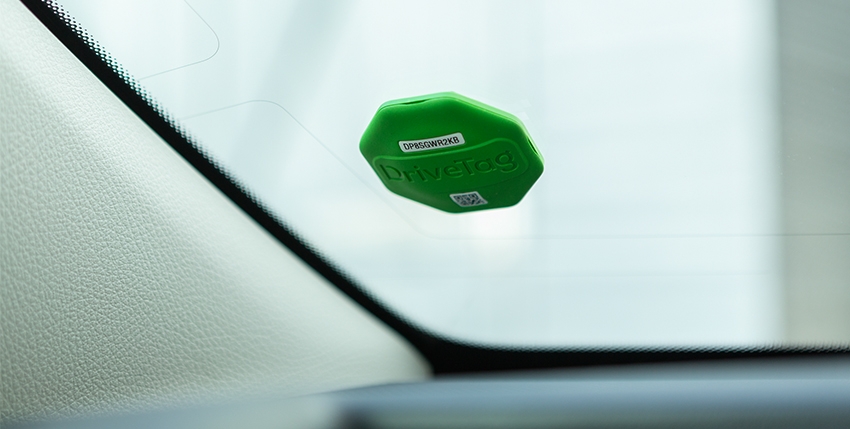

Customers simply stick the small RAC ‘drive tag’ to their windscreen which detects when their car is in use and transmits the distance travelled to the Pay by Mile smartphone app – no other driving-related data is collected. Then, at the end of each month, the customer pays for the miles they’ve driven, and nothing more.

All Pay by Mile policies provide fully comprehensive insurance cover while a vehicle is being driven, and while it’s parked.* Drivers can track their mileage and cost 24/7 via their online account.

Mark Godfrey, managing director of RAC Insurance, said: “Car insurance is a market that’s been ripe for a shake-up for some time, so we’re thrilled to introduce a truly pioneering new product which is ideally suited to drivers who don’t do that many miles.

“With a standard car insurance policy, drivers are expected to estimate how many miles they expect to drive from the outset, whether or not they cover this distance during the policy year or not. For people who don’t drive very regularly or only ever go short distances, this could result in a premium that seems overly expensive.

“Pay by Mile from RAC Car Insurance offers something different. After paying a one-off £50 activation fee and a small set monthly sum that covers the vehicle for all the time it’s parked, drivers just pay a clear ‘per mile’ price of as a little as 4p for every mile they actually drive. This way, motorists save money for whenever they don’t, or can’t, drive.

“The impact of the coronavirus pandemic on driving patterns means it feels like this product has never been more relevant. So many of us are driving fewer miles now, which means we might well be frustrated at how much we’re having to pay for car insurance. With our fast and hassle-free online quote process, it’s easy for drivers to see if they could start saving money with Pay by Mile.

“With monthly, no-ties subscriptions now the norm for so many services we felt the time was right to bring this approach to car insurance – so our new product offers both flexibility and transparency. Pay by Mile customers can easily calculate how much their insurance is costing them from one month to the next. They’re not locked into a 12-month contract that can cost them if their car use suddenly changes. And, if at any point they find a better deal elsewhere, they’re free to leave giving no notice.”

Policies are underwritten by Highway Insurance Company Limited, part of LV=, and the RAC has partnered with insurtech company Wrisk whose platform provides the technical foundation for the novel RAC Pay by Mile experience.

Clive Upton, Head of Standard Private Car for LV= Broker said: “Our partnership with the RAC Pay by miles is a great opportunity to bring a brand-new product into the market that offers customers a tailored monthly subscription, and we’re excited to be part of it.

“We know customer needs are changing when it comes to car insurance, with fewer miles being driven and the need for more flexible cover that suits different lifestyles. By utilising new technology, this will provide transparent value for the exact number of miles driven.”

Nimeshh Patel, CEO Wrisk, said: "We are excited about the launch of this innovative programme with the RAC and look forward to deepening our partnership with them."

In summary: Pay by Mile, from RAC Car Insurance

The new product offers a range of features that makes it radically different from other standard car insurance models, including:

Simple pricing. After paying an initial one-off £50 activation fee, the premium is made up of two parts: the Parked Premium – this is a set charge paid at the beginning of each month to insure the vehicle whilst it’s not being used, and the Mileage Premium – a small per-mile charge for insuring the car while it’s being driven, which is paid at the end of each month

A true monthly subscription – no fees for amending a policy, and customers are free to cancel at any time without being charged

No credit agreement – pay monthly at no extra cost

Management of policy securely online or via the Pay By Mile app

No tricky devices to plug in, and no tracking of driver behaviour – customers just stick the Pay by Mile ‘drive tag’ to their windscreen, pair it with their smartphone, and their miles are recorded

There is a minimum £250 excess with this insurance policy. For more information and to get a quote, visit www.rac.co.uk/insurance/pay-by-mile.

This press release first appeared on the RAC Media Centre.

* Source: National Travel Survey, data last updated 5 August 2020. 2002: total annual car mileage 9,200 miles. Equivalent for 2019: 7,400 miles

Who we are

For over 125 years, the RAC has been at the forefront of developing motoring solutions. Today, you can trust the RAC for complete peace of mind, for all your driving needs.

Discover our history

The RAC has been consistently at the forefront in assisting UK drivers. Take a look at a snapshot of our history so far, beginning in 1897.

Corporate responsibility

The RAC has embedded Corporate Social Responsibility (CSR) throughout the business, with a continued focus on enhancing road safety, improving fuel efficiencies and in developing innovative new products and services for members.